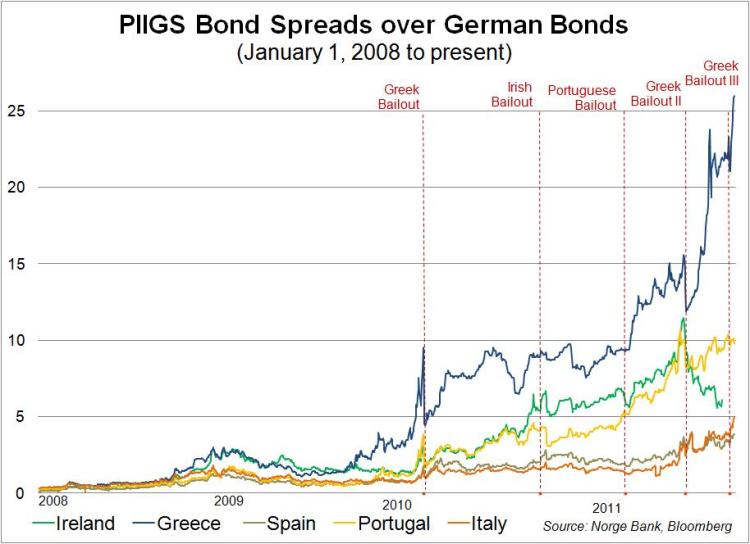

This morning the BBC reported that the yield on 10-year Italian government bonds passed 7% today, which is the highest level since the euro was founded in 1999. Not only is this rate a record level, but it is significant as many observers view 7% as the level where borrowing becomes unsustainable and a bailout will be required. According to the BBC article, this high interest rate would force Italy to borrow money to pay the interest on previous loans, which is unsustainable.

| PIIGS Interest Rates at Time of Bailout | ||

|

10-year yield |

Spread over German bonds |

|

| Greece |

8.27% |

5.31% |

| Ireland |

8.09% |

5.44% |

| Portugal |

8.6% |

5.18% |

| Italy* |

6.77% |

4.97% |

| * Closing rate on Nov. 8, 2011.

Source: Bloomberg |

||

As the above chart shows, there definitely appears to be a threshold for when a Eurozone country needs to receive assistance from the EU et al. All three countries that received bailouts saw their 10-year yields above 8% on the day that the EU reached an agreement to provide the bailout funds. In addition, the spread between the10-year bonds of the country receiving the bailout and Germany were all above 5%. As the chart shows, while Italy might have a little breathing room before it crosses the 8% interest rate, yesterday’s closing rate was dangerously close to the 5% gap.

Even though Italy’s bond spread is still much smaller than Greece and Portugal (see above), a bailout of Italy will be very difficult, as the country has the third largest national debt in the world, at €1.9 trillion (about $2.5 trillion today). This is around 5.5 times the size of Greece’s government debt. While Silvio Berlusconi has pledged to resign soon, it remains to be seen if this action will help save Italy.